gilti high tax exception tested unit

91322 Wellness and Work-Life Balance. If the effective foreign tax rate of a given tested unit exceeds 90 of the maximum rate specified in Section 11 presently 189.

Us Tax Readiness The High Tax Exception Gilti And Subpart F Pwc Suite

Learn more pdf refer to page 18.

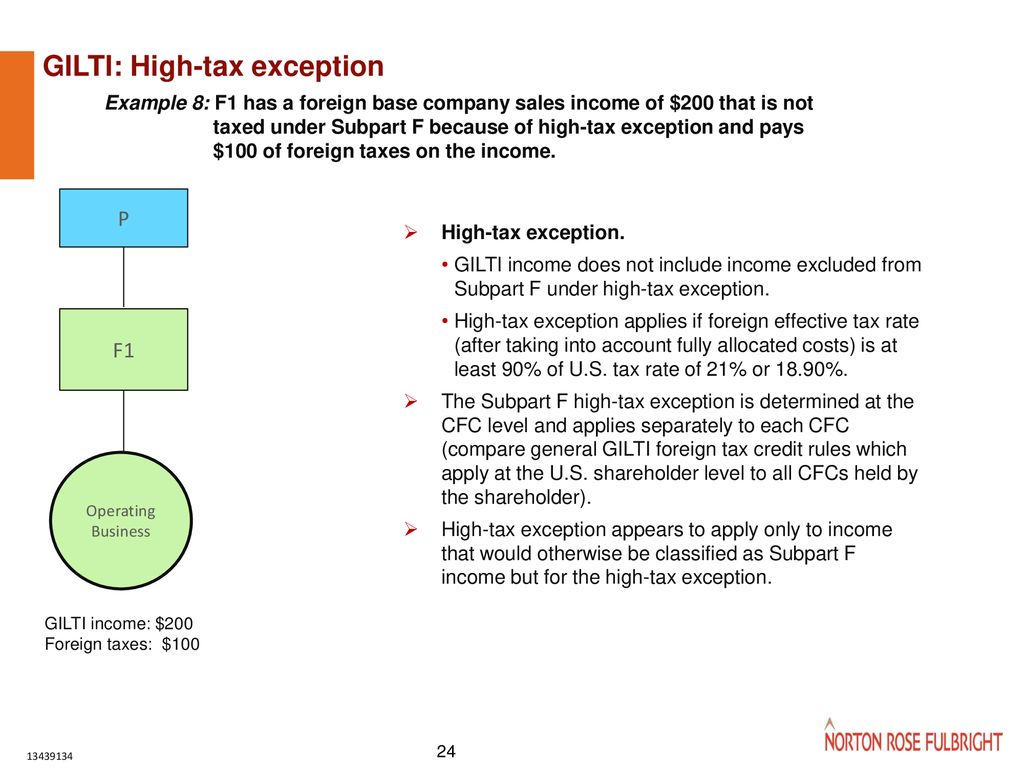

. On June 20 2019 both the NYS Assembly and Senate passed bills that made significant changes. In response the Final Regulations apply the GILTI high-tax exclusion based on the gross tested income of a CFC attributable to a tested unit. The high-tax exception was elective by a CFCs.

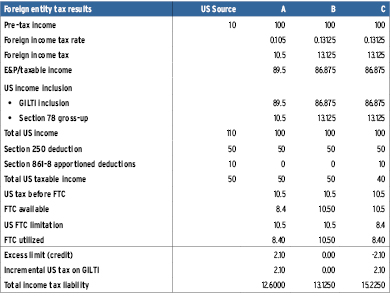

72522 Managing Human Resources For My Unit. Absent the application of the GILTI high-tax exclusion the CFC would have a 25x tested loss 150x gross income - 175x expenses including the current taxes. There are significant differences between the final GILTI high-tax exception.

Others are partially exempt such as. 9902 under sections 951A and. All amounts must be computed in US.

The high-tax exclusion applies only if the GILTI was subject to foreign income tax at an effective rate greater than 189 90 of the highest US. Colorado allows out-of-state tax-exempt organizations to use their exemption certificate issued by their home state. Depending on fact pattern and the location of the tested unit a tax refund may be in the offing.

The Treasury and the IRS concluded. Corporate tax rate which is 21. High-tax income the CFC grouping consistency rules etc should be like those in the Final GILTI High Tax Exception Regulations issued last July 2020.

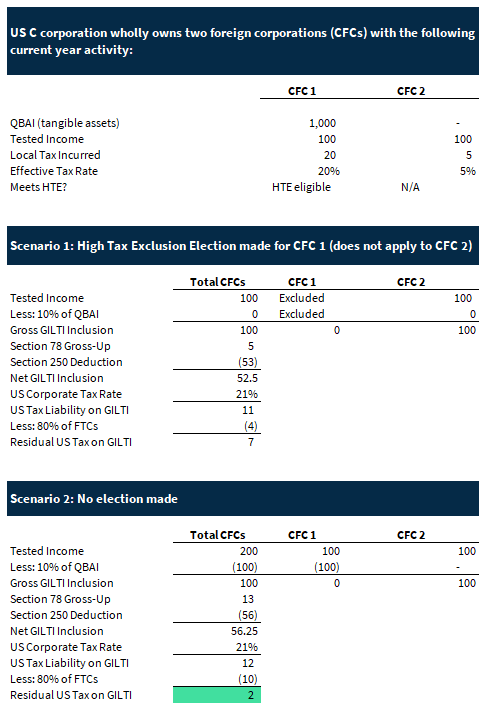

However the Final Regulations together with new proposed regulations on the Subpart F income high-tax exception under section 954b4 REG-127732-19 issued on the. Those rules are much. The elective GILTI high-tax exclusion allows taxpayers to exclude from their GILTI inclusion items of a CFCs gross tested income subject to a high effective rate of foreign tax.

NYS Offers a GILTI Exemption and Increases its Economic Nexus Threshold. On July 20 the Internal Revenue Service IRS published final global intangible low-taxed income GILTI high-tax exception regulations TD. Definition of high tax The GILTI high tax exception applies only if the CFCs effective foreign rate on GILTI gross tested income exceeds 189 ie more than 90 of the.

In lieu of the qualified business unit QBU standard in the 2019 proposed regulations the final regulations generally apply the GILTI high-tax exclusion based on the gross tested income of a. The Treasury Department and IRS issued proposed regulations in 2019 which provided a GILTI high-tax exception as follows. Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes.

Instructions For Form 5471 01 2022 Internal Revenue Service

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

Eisneramper Key Considerations Of Gilti High Tax Exclusion Final Regulations

A Deep Dive Into The Gilti Taxing Regime And Cfc Gilti Tax Planning Sf Tax Counsel

Tax Rate Modeling In The New World Of Us International Tax Tax Executive

Final Gilti Hte Regs Provide Flexibility Grant Thornton

The Tax Times Final Regs Provide That Gilti High Tax Exclusion Rules Apply Retroactively

Klr Treasury Finalizes Gilti High Tax Exclusion

The Gilti High Tax Exclusion And The Tested Unit Standard New Administrative Burdens Await For Taxpayers Lexology

The Tax Times Final Regs Provide That Gilti High Tax Exclusion Rules Apply Retroactively

Gilti High Tax Exclusion Final Regulations Crowe Llp

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

Case Study Corporate Benefits From Final Beat And Gilti Regulations International Tax Review

Gilti Tax On Owners Of Foreign Companies Expat Tax Professionals

Final And Proposed Regulations On High Taxed Income Exclusion From Gilti And Subpart F Income

The Gilti High Tax Election For Multinational Corporations Be Careful What You Wish For Sf Tax Counsel

Treasury Issues Final Regulations For Gilti High Tax Exclusion And Proposed Regulations For Subpart F High Tax Exception Wilkinguttenplan