nh property tax calculator

Take the purchase price of the property and multiply by 15. The 2021 tax rate is 1503 per thousand dollars of valuation.

New Hampshire Property Tax Calculator Smartasset

The outcome is the same when the market value of the properties increases above the assessed value in this case to 275000.

. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor you can use the free New Hampshire Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across New Hampshire. So if your rate is 5 then the monthly rate will look like this.

New Hampshire Property Tax. You might initially assume that if you have no major investments like stocks and bonds that. Minus July taxes paid.

While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country. Equals December tax bill due 325564. The local tax rate where the property is situated.

PO Box 629. The assessed value of the property. While its not a fun number to calculate your portion of the transfer tax will be accounted for on your closing disclosure.

What looks like a significant increase in value may actually turn into a modest increase in your tax bill. For the July 2019 tax bill we will take ½ the current rate of 2196 which is 1098 and multiply that by the new assessed value of 272700 for a total of 299425. If you take out a 30-year fixed rate mortgage this.

The assessed value multiplied by the real estate tax rate equals the real estate tax. Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration. The assessed value multiplied by the tax rate equals the annual real estate tax.

300000 1000 300 x 2306 6910 tax bill. If you would like to get a more accurate property tax estimation choose the county your property. Suburbs 101 is an insiders guide to suburban living.

The 2019 tax. The median property tax homeowners in New Hampshire pay is 5768. Note that this calculator is for estimation purposes only.

The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev 800. 603 230-5945 Contact the Webmaster. The 2020 tax rate is 1470 per thousand dollars of valuation.

Box 629 Wolfeboro New Hampshire 03894 Website. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Property Tax Relief Program.

2013 City of Concord NH. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20.

New Hampshires tax year runs from April 1 through March 31. How to Calculate Your NH Property Tax Bill. Theyre a capital anchor for public services in support of cities schools and special districts including water treatment plants public safety services transportation and more.

This tax is only paid on income from these sources that is 2400 or more for single filers and 4800 or greater for joint filers. Concord NH 603 230-5000 TDD Access Relay NH. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the result by 1000.

NHgov privacy policy accessibility policy. Thoroughly calculate your actual property tax applying any exemptions that you are allowed to use. Assessing department tax calculator.

While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends. As you can see it is not 12 of the previous December tax bill. The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value.

In the court it may make sense to get service of one of the best property tax attorneys in Stark NH. Water. Property taxes are the main source of funds for Milan and the rest of local public entities.

N the number of payments over the life of the loan. Typically in NH transfer tax is split in half between buyer and seller unless otherwise negotiated between. New Hampshire Property Tax Calculator.

Enter your Assessed Property Value Calculate Tax. For comparison the median home value in New Hampshire is 24970000. Look up your property tax rate from the table above.

The result is the tax bill for the year. Use the property tax calculator below to compute your New Hampshire property taxes. In terms of median property tax payments New Hampshires property taxes also rank among the top three in the nation.

However it makes up for it with its property taxes as it boasts the fourth-highest property tax rate in the US. The tax is imposed on both the buyer and the seller at the rate of 75 per 100 of the price or consideration for the sale granting or transfer. 300000 x 015 4500 transfer tax.

603 569-3902 Tax 603 569-8150 Electric 603 569-8158 Water. Town of Wolfeboro 84 South Main St PO. The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value.

2018 Total tax bill. If you would like an estimate of the property tax owed please enter your property assessment in the field below. On average homeowners in New Hampshire pay 205 of their homes value in property tax every year.

2021 Taxes The property tax calculated does not include any exemptions elderly veterans etc that you may be entitled to. With taxes to be raised of 10000 and a town-wide assessed value of 500000 the tax rate would remain 20 per 1000 of valuation and each property would again owe 5000 in property taxes. This calculator is based upon the State of New Hampshires Department of Revenue.

For example the owner of a home with an assessed value of 300000 in a town where the tax rate is 2306 would receive a bill of 6910. Thats the fourth-highest average effective property tax rate in the country. If you would like an estimate of what the property taxes will be please enter your property assessment in the field below.

The RETT is a tax on the sale granting and transfer of real property or an interest in real property.

Property Tax Information Town Of Exeter New Hampshire Official Website

State By State Guide To Taxes On Retirees Retirement Income Income Tax Retirement Benefits

How To Calculate Transfer Tax In Nh

1217 Rosalie Drive Hot Water Tanks House Styles Vinyl Siding

Understanding New Hampshire Taxes Free State Project

New Hampshire Property Tax Calculator Smartasset

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties Reachinghighernh

New Hampshire Income Tax Calculator Smartasset

Litchfield 2021 Property Tax Rate Set Town Of Litchfield New Hampshire

Mortgage Rates Projected To Increase Mortgage Rates 30 Year Mortgage Mortgage

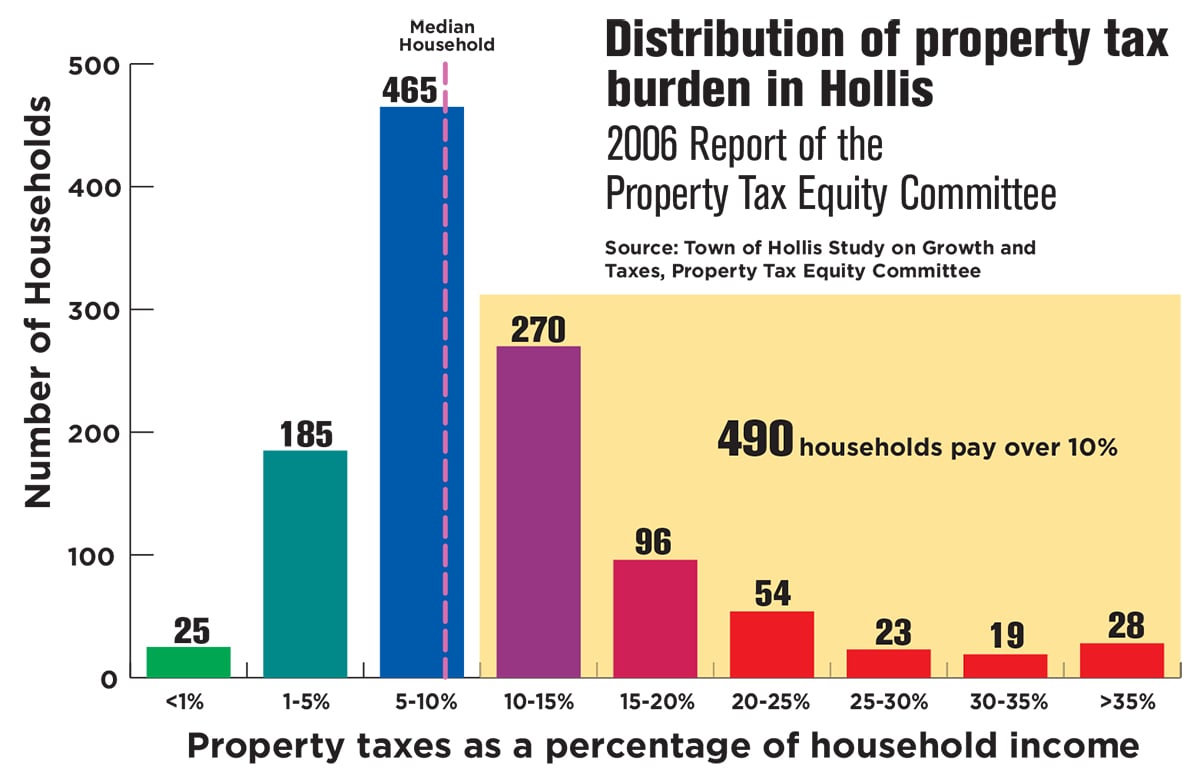

Does New Hampshire Love The Property Tax Nh Business Review

When 30 000 Property Taxes Hit A Little Harder Cnn Business Real Estate Articles Estate Agent Real Estate Companies

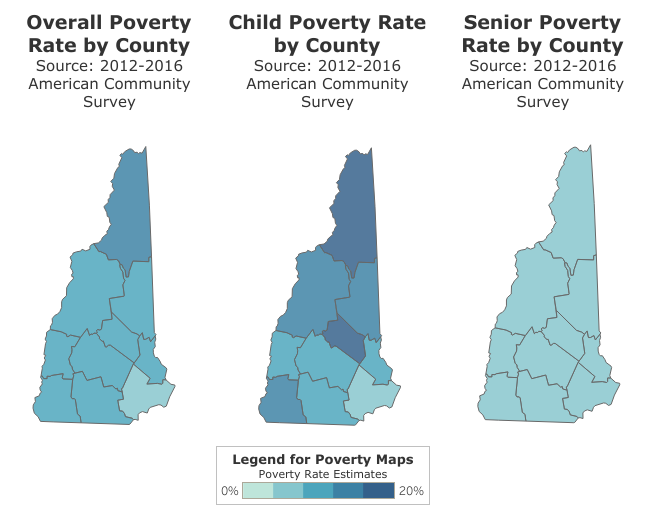

Nh Where Rich Towns Like Rye Get Richer And Poor Ones Like Berlin Need Help Indepthnh Orgindepthnh Org

2021 Tax Rate Set Hopkinton Nh

State By State Guide To Taxes On Retirees Kiplinger

State By State Guide To Taxes On Retirees Inheritance Tax Estate Tax Purple States

Town Manager Announces Tax Rate Set At 26 36 Newmarket Nh

The Best And Worst States For Retirement Ranked Huffpost Life Retirement Best Places To Retire Retirement Community